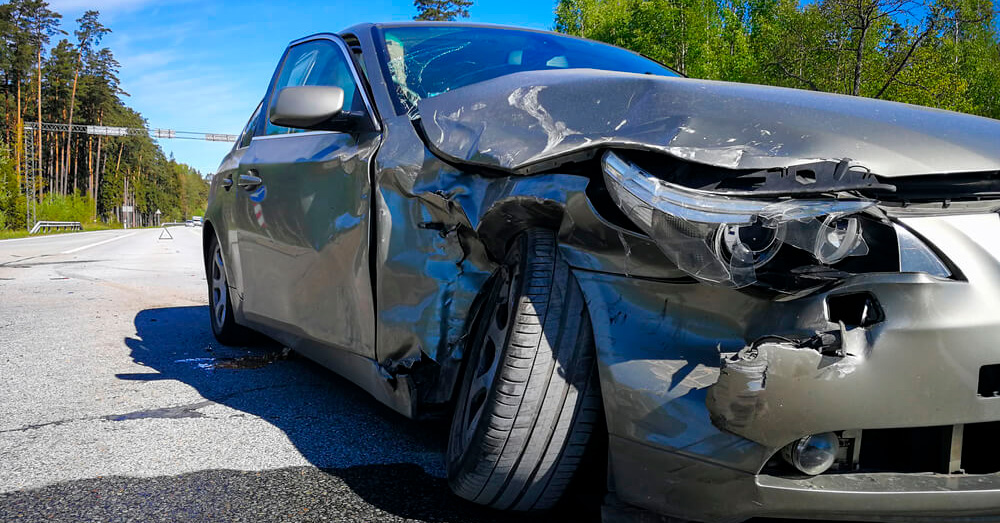

When your car collides, the first thing that comes to your mind is the safety of its passengers, and then that of your car. You might wonder whether it can be turned to the perfect condition or will be declared a total loss. It happens when the cost of repair exceeds your car’s insurance value.

But who decides if it is totaled? In California, this is a state-dependent decision. It is the at-fault driver’s insurance company that determines whether your car needs repair or is too damaged to be fixed. This is how the rule total loss threshold California applies.

While in the US, some states like Florida or Tennessee have a fixed percentage to define a totaled vehicle, California does not. Instead of using a percentage-based rule, the state uses a total loss formula that you need to understand to preserve your rights and take the right steps.

California does not use a set percentage to decide if your vehicle is totaled. It adopts a different approach that is known as the total loss formula. In this method, the repair cost and the current value of your damaged vehicle are added and then compared with its actual cash value before the accident.

If the total of both values (repair cost and salvage value) equals or exceeds ACV, your car is considered a totaled vehicle. You must understand how the California total loss Threshold works if your car is involved in an accident and is in a bad condition. It can help you navigate the further process efficiently in this stressful time.

Before understanding how the rule works, it is essential to know about the few terms:

Now, let us understand with the help of an example how California total loss guidelines work.

Let us assume that your car’s actual cash value is $15,000. The repair cost is $10,000, and the salvage value is $5,000. When the repair cost and scrap value are added, the total is equal to its ACV. It means that your car will be declared a total loss. If vice versa, you may get an option to get it repaired instead of totaling it.

You know that your vehicle is declared totaled, now what's next? Many people mistakenly accept the first offer given by the insurance company. Well, you do not need to do that! Here are a few steps you can take that can help you avoid losing the money or missing your chance to dispute the claim.

The first thing that you may encounter is receiving a settlement offer from the insurance company. It is when your car is deemed a total loss. The amount they offer will be based on the ACV of it before the crash.

However, it will not include the cost you agreed to pay while buying the policy. This is a deductible amount that will be minus from the settlement estimate.

In such a case, when you accept the settlement, the next step is to transfer the ownership of the car to the insurance company. Now they legally own your car and have the right to apply for a salvage title, sell it, or dispose of it.

Another option is to keep the totaled vehicle instead of handing it over to the insurers. Still, you will get a payout from them; however, they will deduct the salvage value from it, and you will get your car back with the salvage title. It means it can not get back on the road until fully repaired and inspected by the officials.

Remember that you are not obliged to accept the settlement. If you believe that your car should not be totaled or the payout is very low, you have the right to file a claim and dispute their decision.

You can seek legal help or hire a professional, independent appraiser for an informed second opinion. They can help you offer more clarification and navigate the claim process efficiently.

Dealing with the aftereffects of a car accident is itself stressful, and if you do not know the further process, it can lead you to make wrong decisions. Either you will accept the low settlement offer or lose your car’s ownership without knowing your options.

Understanding the Total Loss Threshold California Guidelines helps you make a smarter choice. You know the laws, so you can ask the right questions and check if the offer is fair. You can also decide whether to keep your car or let it go.

Furthermore, you can protect your rights and have more control during this stressful situation. It can help you get what you deserve and protect you from losing money or missing out on better options.

Feeling overwhelmed with the total loss claim process? Not anymore! ADR-Claims is there to help you with the claims, clarity on settlement offers, and understanding your options.

The ADR-Claims team provides full support throughout the claim process and offers legal guidance and vehicle appraisal services, too. Reach out to our team for trusted help with your total loss claim in California!

Our quick and simple appraisal process can help you recoup vehicle-related losses.