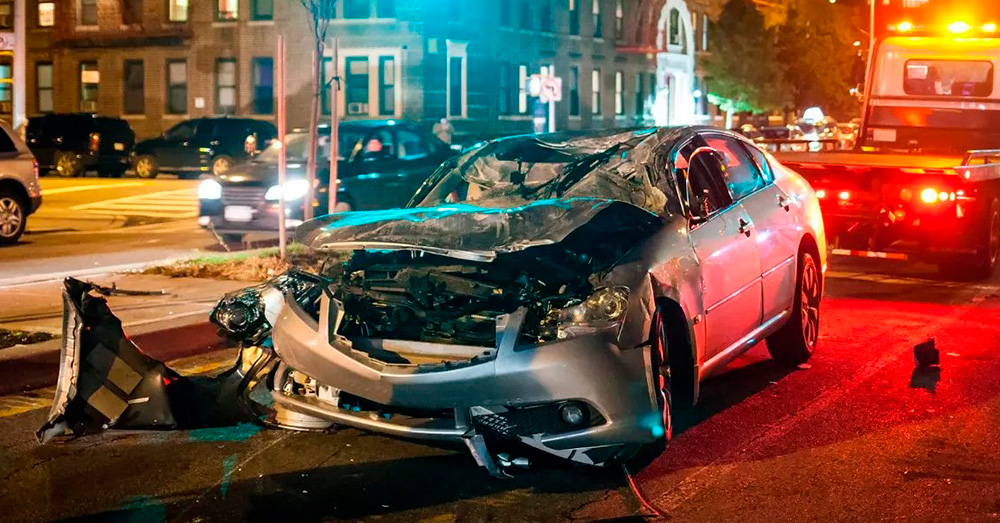

After a severe collision in Maryland, your first concern can be everyone’s safety. Even when everyone is fine, your car might encounter serious damage. To recover this loss, when you reach out to the insurance company to start a claim, it declares your vehicle a total loss.

It says so because the cost to fix your vehicle is way more than its actual worth before the crash. The insurance company decides it by using the state’s law for total loss vehicles. By taking into account this rule, they determine if your car will be repaired or titled a total loss.

This is how the Total Loss Threshold Maryland applies. When involved in a car wreck, you need to understand this law well to protect your financial interests and know what to expect after the total loss decision.

Across the US, the states stick to two main ways to make the decision. Some use the total loss formula, which refers to adding the repair cost and salvage value, then comparing the total with the car’s real worth. The other applies the percentage-based rule.

Maryland does not use the total loss formula to determine if a vehicle is a total loss or needs repair. Instead, the rule is based on the predefined percentage figure, which is 75% of the ACV in the state.

After assessment of the damage, the insurance company uses it and finds if the repair cost is equal to or greater than 75% of the fair market value of your vehicle. If yes, it is deemed as a total loss, and in case no, you will be paid for repairing it and getting it back on the road.

To understand the total loss guideline well, you need to know how an insurance company evaluates total loss. First, they evaluate the ACV based on the given factors such as:

Then, the company moves towards the further process that is to calculating the repair cost. To do it, it sends an agent who evaluates the repair estimate. Or else, it can also get an estimate from the repair shop. If the insurers find the fixing cost exceeding the set fair market value figure, the vehicle is totaled.

Take a look at the following table:

| Repair Cost | Actual Cash Value | Total Loss Threshold | Result |

| $7,500 | $10,000 | 75% of ACV | Totaled |

| $7,000 | $10,000 | 75% of ACV | Repaired |

In the above table, we can see that when the repair cost equals 75% of the pre-cash value, it is declared totaled. And, when it does not exceed, the vehicle will be repaired and returned to you.

The insurance company decides whether to pay for repairs or declare your car a total loss. What are your options then? Well, you can keep the totaled car. However, this can impact your settlement offer too, as the insurance company will deduct the salvage value from the amount.

You are also entitled to apply for the salvage title, then you can repair it and get it inspected by the Maryland Motor Vehicle Administration. When you pass the inspection, you can secure a rebuilt title that allows you to legally drive your car again.

If you disagree with the valuation that the insurers have offered, challenging their decision is also an option. Look at the following steps you may take:

When you are unsure about the ACV settlement offer, you can always opt for the detailed evaluation process. At ADR-Claims, our appraisers conduct it taking into account various factors to provide you with unbiased results. You can use the evaluation report as strong evidence and make your case stronger.

After collecting all the important evidence to support your case, you can start the negotiation process. It can help increase the offer, elevating your chances of success.

If anything is not working, you can seek legal help by consulting with an attorney. With specialization in total loss disputes, these professionals can help you get what you deserve.

Like any other common car owner in Maryland, you might also get confused about the further process, especially when it is your first time. Knowing how the state decides a totaled vehicle can save you from last-minute surprises.

You get to know about the important terms, such as actual cash value, repair cost, evaluation, and more, that you were not familiar with. It helps you prepare well to respond to the total loss decision. Understanding the Maryland Total Loss Threshold helps you manage the situation calmly and responsibly. You learn to make the right choice by taking every step carefully.

Whether it comes to getting a fair settlement, dealing with the total loss claim process, or having appraisal support, ADR Claims is a trusted name to help with. We are here to help you get the desired outcome, ensuring that you do not settle for less than what you deserve.

Our expert team will help you navigate the complex claims process, making sure that you recover your losses. We help protect your rights and make the most out of the options you have. So, why wait? Get in touch with the ADR Claims team today!

Our quick and simple appraisal process can help you recoup vehicle-related losses.